The financial market is abuzz with the latest initial public offering (IPO) by Scoda Tubes. With its grey market premium (GMP) showing a 16% rise, the IPO has sparked significant interest among investors. This development comes as the company opens its doors to bids, presenting a new opportunity in the dynamic landscape of market investments. Let’s delve deeper into what this IPO entails and whether it’s worth parking your money here.

The Business Behind Scoda Tubes

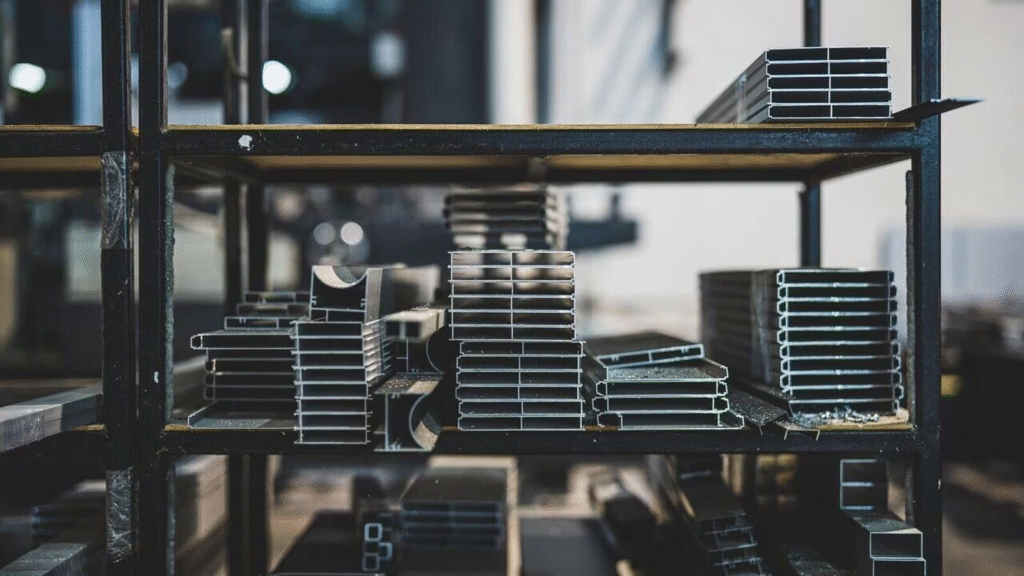

Scoda Tubes has carved a niche in the manufacturing sector with its high-quality tubes and pipe solutions. Catering to a diverse range of industries, the company has demonstrated steady growth and innovation. Its business model revolves around meeting the demand for durable, efficient, and cost-effective products in sectors like oil and gas, construction, and automotive industries.

The company’s financials have shown resilience, even amid economic uncertainties. With robust revenue figures and a sound profit margin, Scoda Tubes has positioned itself as a reliable player in its domain. This strong foundation sets the stage for its IPO, attracting both retail and institutional investors.

In recent years, the company has invested heavily in modernizing its manufacturing facilities, adopting state-of-the-art technology to improve efficiency and reduce production costs. These efforts have not only enhanced product quality but also positioned Scoda Tubes as a leader in sustainable manufacturing practices. The company’s commitment to environmental responsibility has earned it accolades and strengthened its brand reputation in global markets.

IPO Details: What You Need to Know

The Scoda Tubes IPO is structured to appeal to a wide array of investors. Here are the key details:

- Price Band: The IPO is priced competitively, aiming to strike a balance between affordability for retail investors and value generation for the company.

- Lot Size: The minimum bid lot is designed to encourage participation across different segments of the market.

- Issue Size: The offering includes both fresh issue shares and an offer for sale, providing a mix of fundraising for growth initiatives and liquidity for existing shareholders.

These parameters indicate a carefully planned IPO that seeks to maximize participation and ensure a fair valuation. The total issue size is expected to generate significant capital, which will be deployed towards strategic business initiatives. The fresh issue component will primarily fund expansion projects, while the offer for sale provides an exit route for early investors and promoters.

Grey Market Premium (GMP) Surge: A Reflection of Investor Sentiment

The 16% rise in GMP is a critical indicator of market sentiment towards Scoda Tubes. Grey market activities often provide a glimpse into the perceived value of an IPO ahead of its official listing. The upward trajectory in GMP signals strong demand and optimism among potential investors.

Analysts suggest that the GMP surge reflects confidence in Scoda Tubes’ business model, growth prospects, and financial health. However, while GMP is an important metric, it’s essential to consider it alongside other factors before making investment decisions.

Market observers have noted a positive correlation between GMP trends and post-listing performance. While past performance does not guarantee future results, the strong GMP for Scoda Tubes adds a layer of intrigue and expectation. Potential investors should remain vigilant, assessing whether the IPO pricing aligns with intrinsic company value.

Industry Outlook: Riding the Growth Wave

Scoda Tubes operates in a sector that is poised for growth. The demand for advanced piping solutions is driven by infrastructural development, urbanization, and industrial expansion. Governments worldwide are investing heavily in infrastructure, providing a conducive environment for companies like Scoda Tubes.

Additionally, the push towards sustainable and eco-friendly practices is creating new opportunities. Scoda Tubes’ focus on innovative and energy-efficient products aligns well with this trend, enhancing its competitive edge. The global market for industrial pipes and tubes is projected to grow at a compound annual growth rate (CAGR) of 7.5% over the next decade, presenting a significant growth runway for the company.

The rising demand for specialized solutions in sectors such as renewable energy, water treatment, and advanced manufacturing further underscores the strategic importance of Scoda Tubes’ product offerings. By staying ahead of industry trends and continuously evolving its portfolio, the company is well-positioned to capitalize on emerging opportunities.

Evaluating Investment Potential

While the Scoda Tubes IPO presents an exciting opportunity, potential investors must conduct thorough research. Here are some aspects to consider:

Financial Performance

Scoda Tubes’ financial statements indicate a healthy growth trajectory. Revenue growth has been consistent, supported by effective cost management and strategic investments. Profitability ratios, such as return on equity (ROE) and net profit margin, compare favorably to industry benchmarks.

The company’s balance sheet strength is another highlight, with a low debt-to-equity ratio and sufficient liquidity to navigate market uncertainties. This financial stability provides a solid foundation for growth and ensures resilience in the face of economic challenges.

Risk Factors

Like any investment, the Scoda Tubes IPO carries risks. Market volatility, raw material price fluctuations, and competition are some challenges that the company might face. Investors should assess these factors in the context of their risk appetite and investment goals.

Additionally, geopolitical tensions and supply chain disruptions pose potential risks to global operations. Scoda Tubes’ management has outlined contingency plans to mitigate these risks, emphasizing the importance of diversification and strategic partnerships.

Valuation

The IPO’s pricing is a critical determinant of its attractiveness. Analysts recommend comparing the valuation metrics, such as price-to-earnings (P/E) ratio, with peers in the industry. A fair valuation ensures a higher probability of post-listing gains.

Investors should also consider the company’s growth potential in the context of its valuation. While a premium valuation may reflect high growth expectations, it’s crucial to ensure that the pricing aligns with realistic assumptions and market dynamics.

Strategic Growth Plans

Scoda Tubes plans to utilize the IPO proceeds to fuel its expansion initiatives. Key areas of focus include:

- Capacity Expansion: Increasing production capabilities to meet rising demand.

- Research and Development: Innovating new products and improving existing offerings.

- Debt Reduction: Strengthening the balance sheet by reducing financial leverage.

These strategies are expected to enhance the company’s market position and create value for shareholders. The emphasis on R&D underscores Scoda Tubes’ commitment to staying at the forefront of industry innovation, developing cutting-edge solutions to meet evolving customer needs.

Subheading: Mid-Stage Analysis of Scoda Tubes IPO

The story of Scoda Tubes is not just about its products or financials but also its vision for the future. As the bidding process gains momentum, analysts are closely watching how the market responds to this offering. The company’s focus on innovation and customer-centric solutions has earned it a loyal clientele, a factor that is likely to play a pivotal role in its growth story.

Scoda Tubes’ management has outlined an ambitious roadmap for the next five years, targeting significant market share expansion in key geographies. By leveraging its expertise and building strategic alliances, the company aims to solidify its position as a global leader in the tubing industry.

The Role of Institutional Investors

Institutional investors play a critical role in shaping the success of any IPO. Their participation not only provides financial stability but also reflects confidence in the company’s long-term potential. Scoda Tubes has already garnered interest from several prominent institutional investors, signaling a positive outlook for the IPO.

The involvement of institutional players also enhances market credibility, attracting retail investors and boosting overall subscription levels. Analysts believe that the robust institutional response to Scoda Tubes’ IPO underscores the strength of its value proposition and growth potential.

Post-IPO Expectations

Post-IPO, Scoda Tubes is expected to focus on executing its strategic plans efficiently. The infusion of fresh capital will enable the company to accelerate its expansion initiatives and explore new market opportunities. By maintaining a disciplined approach to growth, Scoda Tubes aims to deliver sustainable value for its stakeholders.

Analysts anticipate strong listing gains for Scoda Tubes, driven by its solid fundamentals and favorable market sentiment. However, the long-term performance will depend on the company’s ability to adapt to changing market conditions and execute its vision effectively.

Conclusion: A Balanced Perspective

The Scoda Tubes IPO is undoubtedly an intriguing prospect. With its strong fundamentals, promising industry outlook, and rising GMP, it has captured the market’s attention. However, as with any investment, caution and due diligence are key. Evaluating the IPO against your financial goals and risk tolerance will help you make an informed decision.

The investment landscape is ever-evolving, and opportunities like Scoda Tubes come with their share of potential and challenges. By staying informed and strategic, investors can navigate this landscape effectively, positioning themselves for long-term success.

As Scoda Tubes embarks on this new chapter, it holds the promise of becoming a transformative force in its industry. For investors, the IPO represents not just an opportunity to participate in the company’s growth story but also a chance to contribute to a vision of innovation, sustainability, and progress.