Pakistan’s economic turmoil has reached a critical juncture as the International Monetary Fund (IMF) evaluates Islamabad’s plea for a substantial bailout package. This development follows a prolonged period of fiscal instability, escalating debt, and internal tensions that have pushed the country’s economy to the brink. Amid growing uncertainties, Pakistan’s financial crisis has become a focal point of international scrutiny, especially against the backdrop of strained regional dynamics with India.

The Current State of Pakistan’s Economy

Pakistan’s economy, which has traditionally relied on agriculture, textiles, and remittances, is facing unprecedented challenges. The country’s foreign reserves have plummeted to alarmingly low levels, with the State Bank of Pakistan (SBP) holding only enough reserves to cover a few weeks’ worth of imports. The devaluation of the Pakistani rupee against the US dollar has led to skyrocketing inflation, putting essential commodities like food, fuel, and healthcare out of reach for a significant portion of the population.

A major factor contributing to the economic decline is Pakistan’s ballooning external debt. The country’s external debt, which stands at a staggering $130 billion, continues to increase as it struggles to meet the repayment schedule. Pakistan’s debt-to-GDP ratio has now surpassed 90%, signaling an unsustainable fiscal path. For years, Islamabad has relied on foreign loans to maintain its economic stability, but these loans have only piled on more debt, creating a vicious cycle that has left Pakistan vulnerable to external shocks and destabilizing its domestic economy.

This economic vulnerability has also led to a loss of investor confidence. Stock market indices have faced significant declines, and foreign direct investment (FDI) has dried up. The lack of economic growth and poor governance has made it difficult for the country to attract much-needed investment. The nation’s economy is in desperate need of structural reforms, but the political landscape has hindered such efforts, leaving Pakistan in a precarious position.

The IMF Bailout Request: A Controversial Solution

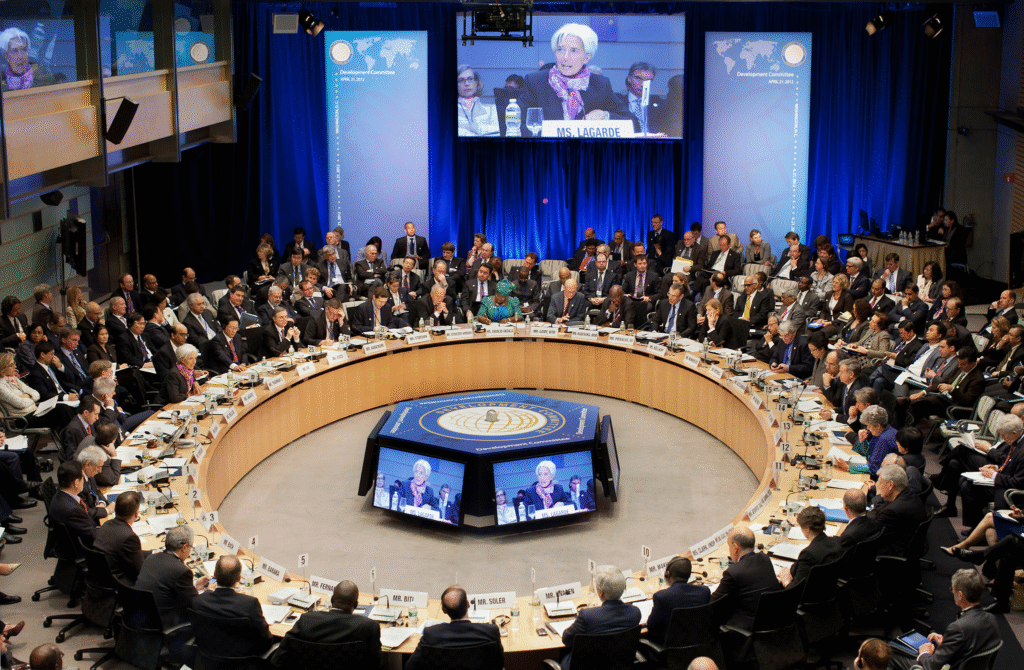

In the face of mounting economic pressures, Pakistan has requested a bailout package from the International Monetary Fund (IMF). The loan, if granted, is expected to help Pakistan meet its immediate financial obligations and stabilize its economy. However, the request has sparked intense debate among policymakers, economists, and the general public.

The IMF is known for providing financial assistance to countries facing severe economic crises, but its bailout packages often come with strict conditions. These conditions typically include austerity measures, fiscal reforms, and the privatization of state-owned enterprises. While supporters argue that the IMF bailout is necessary to prevent a collapse of Pakistan’s economy, critics argue that the conditions attached to the loan could worsen the country’s social and political instability.

Pakistan has a long history of turning to the IMF for assistance. In fact, the country has entered into multiple agreements with the IMF over the past few decades, but these loans have often led to further economic hardships for ordinary citizens. The imposition of austerity measures, which typically involve reducing government spending and increasing taxes, has led to widespread protests and public discontent in the past.

Moreover, the IMF’s requirement for Pakistan to implement structural reforms, such as reducing subsidies and increasing privatization, could have long-term negative effects on the country’s social fabric. With millions already living below the poverty line, any further cuts to social programs or increases in utility prices could spark widespread protests, making it increasingly difficult for the government to maintain social order.

Austerity Measures and Their Impact

If the IMF bailout request is approved, Pakistan will likely have to adopt stringent austerity measures aimed at reducing fiscal deficits and restoring economic discipline. These measures will not only have a significant impact on the country’s economy but also on the daily lives of its citizens.

One of the key components of the IMF’s bailout package is likely to be a reduction in government subsidies on essential goods and services. Pakistan has traditionally provided subsidies on fuel, electricity, and food items to ease the burden on low-income families. However, these subsidies have placed a significant strain on the country’s fiscal budget, and the IMF is likely to demand their reduction as part of the bailout conditions. This will result in higher prices for basic commodities, further exacerbating the cost-of-living crisis that already affects millions of Pakistanis.

Another key condition that Pakistan will likely have to meet is the implementation of tax reforms. Pakistan’s tax collection system has been notoriously inefficient, with a significant portion of the economy operating in the informal sector and paying little or no taxes. The IMF will likely insist on broadening the tax base and increasing tax rates to improve government revenue. However, this will place additional pressure on already struggling households, as higher taxes will further strain their purchasing power.

Privatization is another major reform that Pakistan is likely to face as part of the IMF package. Pakistan has a large number of state-owned enterprises, many of which are financially unviable and require substantial government subsidies to remain operational. The IMF will likely demand that these enterprises be privatized or restructured to reduce the fiscal burden on the government. While privatization may help reduce public sector debt, it could also lead to job losses and increased unemployment, further destabilizing the country’s fragile labor market.

The Geopolitical Angle: Strains with India

The timing of Pakistan’s economic crisis coincides with heightened tensions with neighboring India. The two countries have a long history of conflict, with disputes over the Kashmir region being one of the most contentious issues. While the geopolitical rivalry between India and Pakistan has always existed, the current economic situation in Pakistan has added another layer of complexity to the bilateral relationship.

Pakistan’s economic vulnerabilities have left it with limited diplomatic leverage in dealing with India. India’s robust economic growth and its strategic alliances with global powers like the United States and the European Union have positioned it as a major regional player. In contrast, Pakistan’s declining economic strength has restricted its ability to exert influence on the world stage. As the two countries continue to navigate a delicate balance of power in South Asia, Pakistan’s economic fragility has made it more susceptible to external pressure.

The strained relationship between the two countries has been further exacerbated by Pakistan’s ongoing internal instability. As Pakistan grapples with its economic crisis, it is facing mounting criticism over its handling of political unrest, religious extremism, and security concerns. While India has been able to focus on economic growth and regional influence, Pakistan has struggled to address the underlying challenges that have hindered its development.

Internal Challenges: Political and Social Instability

Pakistan’s internal political and social challenges have compounded the country’s economic woes. The political landscape in Pakistan is marked by frequent instability, with governments changing frequently and political parties often at odds with one another. The lack of political continuity has made it difficult to implement long-term economic reforms, as successive governments have focused more on short-term survival rather than long-term solutions.

The political discord in Pakistan has spilled over into social unrest, with widespread protests and demonstrations erupting in response to the country’s economic hardships. The rising cost of living, combined with high unemployment and inadequate social services, has led to growing discontent among the population. Pakistan’s political leaders have been unable to address these issues effectively, and as a result, public confidence in the government has eroded.

Additionally, the security situation in Pakistan remains precarious, with terrorism and extremism continuing to pose significant challenges. The country’s security forces are engaged in ongoing operations against militant groups, but these efforts have had little impact on the overall stability of the country. The inability to restore law and order has further weakened Pakistan’s position on the global stage.

The IMF’s Perspective

From the IMF’s perspective, approving a bailout for Pakistan is a complex decision. The organization’s mandate is to ensure that loans are used effectively to promote economic stability and sustainable growth. The IMF’s leadership is aware of the risks associated with lending to a country like Pakistan, which is facing deep-rooted structural issues, political instability, and governance challenges.

The IMF will likely require Pakistan to implement a series of reforms to address the underlying causes of the economic crisis. These reforms will focus on improving fiscal discipline, enhancing the efficiency of public sector institutions, and boosting private sector investment. However, the IMF’s involvement will also raise concerns about Pakistan’s sovereignty and its ability to implement reforms that benefit its citizens.

The Path Forward: Opportunities and Challenges

Despite the challenges, Pakistan’s current situation also presents an opportunity for reform and economic revitalization. The country has significant untapped potential in sectors such as technology, manufacturing, and renewable energy. With the right policies in place, Pakistan could diversify its economy and reduce its dependence on traditional sectors like agriculture and textiles.

The key to Pakistan’s recovery lies in implementing comprehensive and sustainable reforms. This includes improving the efficiency of tax collection, reducing corruption, and promoting investment in high-value sectors. Additionally, Pakistan needs to enhance its governance structures to ensure that public services are delivered efficiently and transparently.

Public Sentiment and the Road Ahead

The public’s sentiment regarding the IMF bailout will play a crucial role in its success. To gain public support, the government will need to demonstrate that the reforms will lead to tangible improvements in people’s lives. This could include addressing inflation, reducing unemployment, and improving access to basic services like healthcare and education.

Effective communication and transparency from the government will be critical in building public trust. The government must clearly articulate the rationale behind the bailout and the expected benefits of the proposed reforms. If successful, these efforts could help stabilize the country’s economy and pave the way for a more resilient future.

Conclusion

As Pakistan awaits the IMF’s decision on its bailout request, the stakes have never been higher. The outcome of this meeting will determine not only the immediate fate of Pakistan’s economy but also its long-term prospects in the global arena. While the challenges are daunting, they also present an opportunity for Pakistan to address its structural weaknesses and build a more sustainable and resilient economy.

The road to recovery will be long and fraught with challenges. However, with strategic planning, effective implementation, and public support, Pakistan can emerge stronger from this crisis. The IMF bailout, if granted, will provide crucial support, but it is the country’s ability to implement reforms and improve governance that will determine its future economic trajectory.