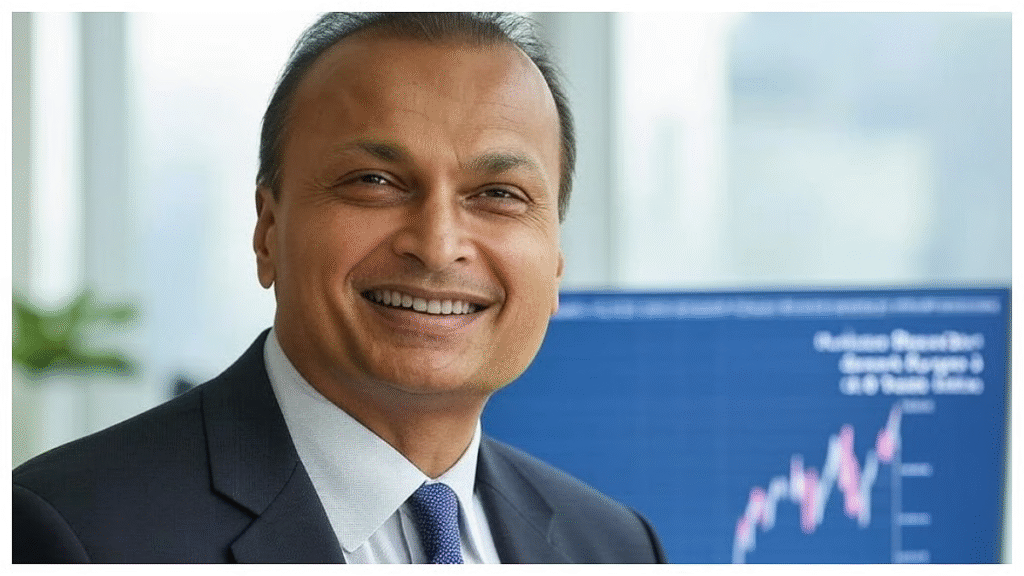

The Indian stock market began the week with a remarkable surge, showcasing an impressive display of bullish momentum. On the first trading day of the week, key indices recorded significant gains, further solidifying investor confidence. Amidst this, the stocks of Reliance Power, a company under the leadership of Anil Ambani, became the center of attention, achieving record-breaking performances and symbolizing a new chapter of financial optimism.

Market Overview: A Day of Unprecedented Growth

The opening bell of the stock market resonated with a sense of optimism as investors, both domestic and international, flocked to capitalize on lucrative opportunities. The benchmark indices, Nifty 50 and Sensex, soared to new highs, driven by a confluence of factors including robust corporate earnings, positive global cues, and a surge in liquidity.

The market sentiment was further buoyed by the Government of India’s policy measures aimed at fostering economic recovery and growth. With industries such as IT, banking, and renewable energy witnessing substantial inflows, the day marked a celebration for market participants who had placed their bets on India’s growth story.

Reliance Power: The Star Performer

Among the numerous stocks that surged, Reliance Power emerged as the undisputed star of the day. The company’s stock witnessed an extraordinary rally, reaching unprecedented levels and marking a significant milestone in its journey. This meteoric rise was fueled by a series of strategic moves, including debt restructuring, improved operational efficiency, and the company’s renewed focus on sustainable energy solutions.

Anil Ambani’s leadership played a pivotal role in steering Reliance Power toward profitability. Market analysts lauded the company’s efforts to adapt to evolving energy demands, with a particular emphasis on renewable and clean energy projects. This forward-thinking approach not only enhanced the company’s valuation but also aligned it with global trends in sustainable development.

Factors Driving the Rally

The remarkable performance of Reliance Power and the broader market can be attributed to several key factors:

- Economic Revival: India’s economic recovery post-pandemic has been robust, with GDP growth projections indicating a positive trajectory. This has reignited investor confidence in Indian equities.

- Global Market Trends: Positive developments in global markets, including easing inflationary pressures and dovish central bank policies, provided a favorable backdrop for emerging markets like India.

- Sectoral Strength: The energy sector, particularly renewable energy, emerged as a strong contender, attracting substantial investments. Reliance Power’s strategic initiatives in this domain acted as a catalyst for its stock performance.

- Investor Optimism: The retail investor base in India has expanded significantly, contributing to increased trading volumes and liquidity in the market.

Anil Ambani’s Strategic Vision

Anil Ambani’s journey with Reliance Power has been a testament to resilience and strategic acumen. Despite facing challenges in the past, the company’s revival is a reflection of his commitment to innovation and adaptability. By pivoting towards renewable energy, Reliance Power has positioned itself as a key player in India’s energy transition.

Ambani’s emphasis on leveraging technology and sustainable practices has resonated well with investors. The company’s projects in solar and wind energy have not only garnered financial backing but have also contributed to India’s ambitious renewable energy targets.

A New Era for Reliance Power

Reliance Power’s stellar performance on the stock market has not gone unnoticed. Market experts believe that this marks the beginning of a new era for the company. With plans to expand its portfolio of clean energy projects and enhance its operational efficiencies, the company is well-poised for long-term growth.

The strategic focus on reducing debt has also been instrumental in improving investor sentiment. By prioritizing financial discipline, Reliance Power has managed to regain the trust of stakeholders, further fueling its stock market rally.

Broader Market Implications

The rise of Reliance Power and other energy stocks underscores a broader trend in the market—the growing significance of sustainable and ESG (Environmental, Social, and Governance)-compliant investments. Investors are increasingly gravitating towards companies that prioritize environmental sustainability and corporate responsibility.

This shift in investment preferences is not just a trend but a reflection of the changing dynamics of global markets. As governments and corporations worldwide commit to net-zero emissions and climate-friendly policies, companies like Reliance Power are reaping the benefits of being ahead of the curve.

Market Sentiment Across Sectors

While Reliance Power took the spotlight, other sectors also witnessed notable gains. The banking sector, buoyed by strong quarterly earnings, contributed significantly to the market rally. IT stocks also gained traction, supported by a weakening dollar and strong demand for digital transformation services globally.

The automotive sector displayed a mixed performance, with electric vehicle (EV) manufacturers leading the charge. This aligns with the broader trend of sustainability, as consumers and businesses alike embrace eco-friendly solutions. These developments underscore the interconnected nature of market performance, where advancements in one sector often ripple across others.

What Lies Ahead

The future of the Indian stock market and Reliance Power looks promising. With global economic conditions showing signs of stabilization and domestic policies favoring growth, the market is likely to maintain its upward trajectory. For Reliance Power, the focus will be on executing its projects efficiently and continuing to innovate in the renewable energy space.

Analysts predict that the company’s stock has the potential to scale new heights, provided it maintains its strategic focus and leverages emerging opportunities. As India progresses towards becoming a global economic powerhouse, Reliance Power’s journey will undoubtedly be one to watch.

The Role of Retail Investors

A notable development in recent years has been the increasing participation of retail investors in the stock market. With access to digital trading platforms and financial literacy initiatives, individual investors are now a driving force behind market movements. Reliance Power’s surge exemplifies how retail investors are quick to identify and capitalize on growth opportunities.

This democratization of investing has brought a new dynamic to the market. While institutional investors continue to play a dominant role, the influence of retail participation cannot be underestimated. This trend is likely to grow as more individuals recognize the potential of equities as a wealth-creation tool.

Conclusion: A Day to Remember

The first trading day of the week has set a positive tone for the Indian stock market. With Reliance Power leading the charge, the day’s performance is a testament to the resilience and dynamism of Indian equities. Anil Ambani’s vision and the company’s strategic initiatives have not only propelled its stock to new highs but have also inspired confidence among investors.

As the markets continue to evolve, the spotlight remains on companies that prioritize innovation, sustainability, and financial discipline. Reliance Power’s remarkable journey serves as a reminder of the immense potential that lies within India’s corporate landscape, making it a story worth celebrating.

Global Comparisons and Lessons for India

India’s stock market trajectory, while unique in its domestic drivers, shares parallels with global trends. Emerging markets worldwide have seen a renewed interest as investors seek high-growth opportunities. The success of Reliance Power and similar companies highlights the importance of adaptability and innovation in staying competitive on a global scale.

Global counterparts in the renewable energy sector, such as Tesla in the United States and Orsted in Denmark, have set benchmarks for excellence. Reliance Power’s focus on renewable energy positions it well to compete on a global stage, potentially attracting international investors seeking exposure to India’s growth story.

The lessons from global markets are clear: companies that prioritize sustainability and embrace technological advancements are better equipped to navigate the challenges of a rapidly changing world. Reliance Power’s strategic pivot aligns with this vision, signaling a bright future for the company and its stakeholders.

The Long-Term Outlook

Looking ahead, the Indian stock market is poised for sustained growth. The government’s emphasis on infrastructure development, digital transformation, and green energy will create new opportunities for companies across sectors. Reliance Power’s success story is a microcosm of the broader economic narrative, where resilience and innovation drive progress.

Investors, both domestic and international, are likely to remain optimistic about India’s prospects. The combination of a young workforce, a burgeoning middle class, and supportive policies provides a strong foundation for long-term growth. For companies like Reliance Power, the challenge will be to maintain their momentum and continue delivering value to shareholders.

Final Thoughts

The remarkable performance of the stock market on the first trading day of the week serves as a reminder of the opportunities and potential that lie within India’s economy. Reliance Power’s journey, under the visionary leadership of Anil Ambani, exemplifies the rewards of resilience, innovation, and strategic foresight. As the markets evolve, the stories of companies like Reliance Power will continue to inspire and shape the future of Indian equities, making them a beacon of hope and growth in the global financial landscape.