The Indian stock market landscape continues to evolve with growing complexities, and amidst this backdrop, Tata Motors has emerged as a strong beacon for cautious investors. While broader indices experience significant turbulence due to macroeconomic and geopolitical concerns, investors are increasingly pivoting toward safer, fundamentally robust companies. Tata Motors, with its historical credibility and aggressive yet balanced strategies, has naturally entered the spotlight. With its share price reflecting resilience and promise, analysts and market participants alike are paying closer attention to this automotive giant’s trajectory.

Stability Becomes the Key as Market Turns Volatile

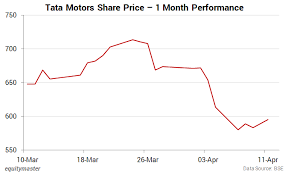

Recent months have seen heightened market volatility. A cocktail of factors, including persistent global inflation, interest rate hikes, weakening global demand, and fears of economic recession, have left investors wary. Against such a backdrop, the importance of low-beta stocks—those that show less price volatility compared to the overall market—has been reasserted. Tata Motors, known for its consistent performance across cycles, has stood out as an anchor stock, helping portfolios remain steady amid widespread choppiness.

Historically, investors have been drawn to Tata Motors for its market leadership in India, dynamic international presence, and its commitment to innovation. Now, with heightened risk aversion prevailing, these attributes are even more valuable. Tata Motors’ share price has thus become a point of discussion not only among retail investors but also among seasoned institutional players.

Tata Motors: A Symbol of Consistency and Growth

There is little doubt that Tata Motors has transformed itself in recent years. Moving beyond being just an automotive manufacturer, the company has evolved into a symbol of futuristic thinking, sustainability, and customer-centric innovation. Its expansion in the electric vehicle segment, strategic investments in green technology, and a stronger push toward premium offerings have redefined its market positioning.

Despite intense competition in the Indian automobile sector, Tata Motors has maintained its lead in several categories, a fact that bodes well for its future growth. Meanwhile, the company’s international operations, spearheaded by its luxury vehicle brand Jaguar Land Rover (JLR), continue to provide an important revenue cushion. Tata Motors’ ability to diversify and adapt has provided critical stability to its share price, even when global markets turned stormy.

Investor Sentiment Turning Positive on Tata Motors

Investor sentiment surrounding Tata Motors has been noticeably improving over the past several quarters. The company’s steady financial performance, impressive product launches, and progressive approach toward future mobility have contributed to enhanced investor confidence. Analysts frequently highlight Tata Motors as a stock worth holding for medium to long-term gains, given its strong fundamentals.

Moreover, the management’s prudent fiscal policies, including significant debt reduction initiatives and a strong emphasis on operational efficiency, have fortified the company’s standing. Investors are particularly encouraged by Tata Motors’ demonstrated ability to weather storms—be it supply chain disruptions, semiconductor shortages, or inflationary pressures—without compromising long-term strategy.

The Role of Global Factors in Shaping Tata Motors’ Outlook

Tata Motors’ fate is not just tied to domestic performance but also hinges significantly on global economic currents. International trends, from recovery patterns in developed economies to commodity price movements, exert an undeniable influence on its operations. The easing of supply chain bottlenecks and the stabilization of semiconductor availability have played an instrumental role in strengthening JLR’s performance, contributing positively to Tata Motors’ consolidated revenues.

Furthermore, demand for luxury vehicles in key markets such as the United States and China has rebounded, providing fresh momentum. While risks persist—such as potential slowdowns in these regions due to monetary tightening—Tata Motors’ diversified geographic footprint helps mitigate such threats to a considerable extent. This global agility is factored into current valuations and is increasingly recognized by discerning investors seeking stable growth.

Strategic Moves Strengthening Tata Motors’ Position

A defining feature of Tata Motors’ recent journey has been its strategic clarity. Instead of resting on legacy strengths, the company has consistently pursued new opportunities with calculated aggression. Its emphasis on electric vehicles has yielded early dividends, capturing a significant share of India’s fast-expanding EV market.

The company’s partnerships with technology providers, investments in battery manufacturing, and focused R&D initiatives underscore a serious commitment to future-proofing its business. Tata Motors’ ambition to lead India’s transition to sustainable mobility aligns perfectly with national goals, further endearing it to government policymakers and investors alike.

Strategically, Tata Motors has also rationalized its product portfolio, exited non-core businesses, and streamlined operations to enhance profitability. Such decisive moves have strengthened the company’s bottom line, making its share price less susceptible to temporary market dislocations.

Low Beta Appeal Boosts Tata Motors Amid Broader Market Caution

Low-beta stocks are currently enjoying a resurgence in popularity, and Tata Motors fits neatly into this narrative. In contrast to high-flying but high-risk sectors like technology or speculative small caps, Tata Motors offers a more predictable return profile, which is precisely what investors now seek.

With a beta lower than many sector peers, Tata Motors’ stock has shown the ability to absorb shocks better, making it a preferred choice among fund managers looking to de-risk their portfolios. The combination of steady operational cash flows, a strong domestic franchise, and an improving international business underpins the company’s relative stability.

This dynamic ensures that even as markets remain jittery about inflation, rates, or global growth concerns, Tata Motors’ stock continues to act as a stabilizer, generating steady wealth creation opportunities for patient investors.

Tata Motors’ Financial Resilience Inspires Confidence

At the heart of Tata Motors’ investment case lies its impressive financial turnaround story. Years ago, concerns regarding debt levels and cash burn at JLR weighed heavily on investor sentiment. However, recent management actions have significantly altered this narrative. The company’s focus on free cash flow generation, reduction of net automotive debt, and maintenance of liquidity buffers have earned it a positive reassessment from credit rating agencies and brokerage firms alike.

Tata Motors’ ability to self-fund its ambitious electric vehicle expansion and other capex plans without excessively leveraging the balance sheet is a testament to its operational maturity. Investors increasingly view Tata Motors not just as a cyclical play but as a structurally improving company with multi-year growth levers.

Future Outlook for Tata Motors Share Price

As we look toward the future, multiple tailwinds support a bullish outlook for Tata Motors’ share price. Domestically, vehicle demand remains strong, particularly for SUVs and electric vehicles—segments where Tata Motors commands an enviable position. The government’s push for EV adoption through incentives and policy support further strengthens the company’s prospects.

On the international front, JLR’s gradual recovery and increased focus on EV and hybrid models cater to changing consumer preferences, offering Tata Motors an excellent opportunity to consolidate its global stature. If economic conditions stabilize, particularly in China and Europe, JLR’s earnings could surprise positively, providing further upward momentum to Tata Motors’ consolidated earnings.

Additionally, the company’s proactive cost-control measures, platform synergies across vehicle categories, and intelligent use of technology position it well to handle any unforeseen economic turbulence. Consequently, many market experts advise a “buy on dips” strategy, highlighting that Tata Motors remains a fundamentally strong name capable of delivering consistent shareholder value.

Expanding Electric Vehicle Footprint: A Gamechanger for Tata Motors

One of the most exciting areas for Tata Motors is its electric vehicle portfolio. The company’s aggressive strategy to dominate the EV space has already yielded strong results, with Tata Motors holding a commanding share in India’s nascent but fast-growing EV market. Models like the Nexon EV and Tigor EV have seen tremendous traction among consumers, and upcoming launches are expected to further boost volumes.

Moreover, Tata Motors’ comprehensive EV ecosystem strategy—including battery development partnerships, setting up public charging infrastructure, and software integration—positions it uniquely among Indian manufacturers. Global investors eyeing sustainable investments are particularly enthused by Tata Motors’ EV play, adding another layer of support to its share price.

Tata Motors and Sustainability: A New Growth Paradigm

Sustainability has moved from being a buzzword to becoming a core operational pillar for businesses worldwide, and Tata Motors has embraced this transformation wholeheartedly. The company’s focus on producing eco-friendly vehicles, reducing manufacturing emissions, and integrating sustainability goals into its business model strengthens its brand value and future readiness.

Investors increasingly reward companies that demonstrate tangible ESG (Environmental, Social, Governance) initiatives. Tata Motors’ commitment to achieving net-zero carbon emissions in its operations by 2040, improving energy efficiency across plants, and promoting circular economy practices enhances its attractiveness to ESG-focused investment funds.

In a market where environmental compliance and sustainable growth will soon become prerequisites rather than options, Tata Motors’ early mover advantage gives it a significant competitive edge.

Conclusion: A Promising Bet Amid Market Uncertainty

Tata Motors has managed to navigate a complex macroeconomic environment with commendable agility and strategic vision. While the road ahead may not be free of bumps, the company’s solid foundation, proactive management, strong balance sheet, and innovative thrust place it among the most resilient and promising players in the market.

As investors increasingly recalibrate their portfolios to favor fundamentally strong, low-beta, future-ready companies, Tata Motors emerges as a natural choice. Its share price stability, combined with robust growth potential, makes it a compelling story in the Indian equity market.

Whether viewed through the lens of financial metrics, market leadership, innovation, or sustainability, Tata Motors stands tall. As broader market volatility persists, Tata Motors’ stock offers not just refuge but also an exciting long-term opportunity for investors who believe in the company’s ability to create value amid changing times.